IIIT-H is proud to celebrate its Silver Jubilee on Sept 2, 2023. IIITH like its Banyan Tree has grown roots to establish itself and sprouts branches into the future.

We have grown from the initial capacity of 100 to 2000 students and 100 faculty members today. We aim to double the strength in the next decade. This scaling calls for an increase in the physical infrastructure as well as academic research.

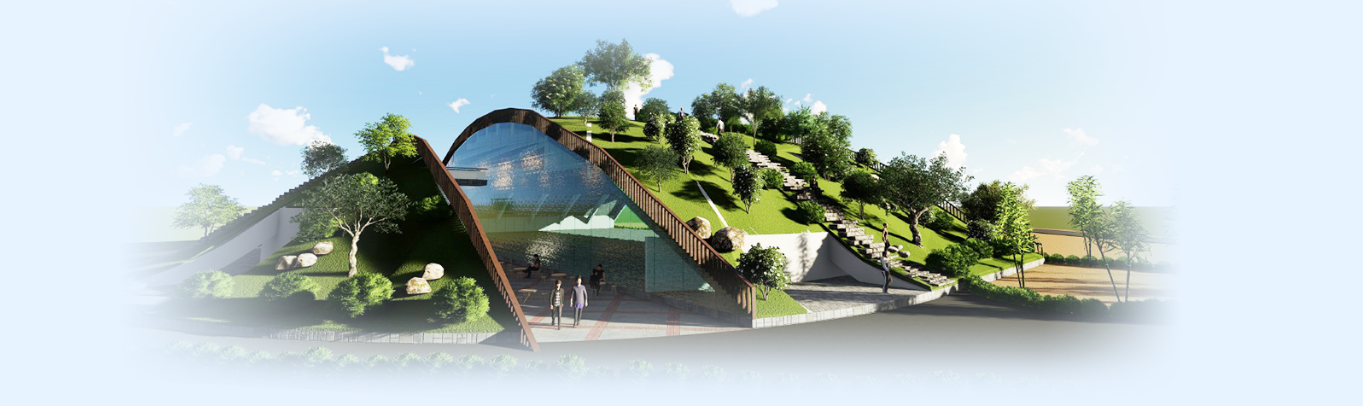

The first and most immediate need for the institute is infrastructure. The institute is crippled in not having adequate space for the students it would like to admit. A new academic block and student activity center is essential to nurture more students on the campus. We aim to construct one, repurposing the space available, without compromising our greenery to mark our 25th anniversary. Other equally important needs of the institute will also be addressed alongside to make our growth balanced and wholesome. From having to repurpose and repair preconstructed buildings, we are excited to design and build new ones that will serve our specific needs. We will mark the 25th anniversary with iconic structures that will equally be a hallmark of IIITH as is its quality of education and research

The generation of resources for this growth is of utmost importance. To make our vision into reality the institute is embarking on the Silver Jubilee Fundraiser dedicated to this effort.

100 CORES (60 CRORES FOR INFRASTRUCTURE)

Academic block – 8550 SQ.M (92000 SQ.FT) with large classrooms (300 seats – 2 ; 200 seats – 4 ; 150 seats – 4 ; 120 seats – 4 … ) electronics and computer labs, library, student workspaces…

Student Recreation and Introspection Center (SRIC) – 1650 SQ.M (17,760 SQ.FT) with student conference, student offices, food court, gymnasium, badminton courts, squash courts, arogya, creche, merchandise store, lounges, banquet hall …

Student Activity and Recreation Center SRIC

Every contribution is valuable. No amount of contribution by you will be small and each ‘giving’ when combined wirh those of others, will go a long way in helping us reach our goal.

Academic block

Naming rights

Name of donor / family member / family / institution / alumni batch to physical infrastructure on the campus (old and new) / bricks on walls / specially constituted awards / events / research faculty chair/ research centers / areas of excellence

Advisory

Becoming a part of advisory / steering committees for endowment/ alumni advisory / public relations / education / start-up advisory Special invitations to our flagship institute events, workshops and peer networking events

Media

Donor list on our website, features in our blogs, newsletter and exclusive interviews, coffee table book and press releases.

Service to Society

Opportunity for meal preparation on campus and named meal donations to society Named tree planting and go-green efforts

Becoming a part of the IIITH family

Sneak preview to our patents / path breaking research/ pitch day of IIITH

start-ups/ alumni start-ups / preferential placement slots

Research collaboration opportunities

A free furnished place to stay on the campus during your visit

If you are an alumnus/alumna, please login at https://alumni.iiit.ac.in and click on the DONATE button

Important: Please provide the PAN details for INR donations of or above Rs. 50,000. As you contribute, please intimate us on alumnifund@iiit.ac.in. This will help us track your contribution better.

Through cheque/draft

payable to

Postal Address: Alumni Affairs,

Admin Block – 3rd Floor,

International Institute of Information Technology Hyderabad,

Prof. C R Rao Road, Gachibowli,

Hyderabad 500 032,Telangana, INDIA

Through Credit Card/Debit Card (Visa/Master Card)

Through cheque/draft

payable to

INTERNATIONAL INSTITUTE OF INFORMATION TECHNOLOGY

Postal Address: Alumni Affairs,

Admin Block – 3rd Floor,

International Institute of Information Technology Hyderabad,

Prof. C R Rao Road, Gachibowli,

Hyderabad 500 032,Telangana, INDIA

| Contributors | Allowed Deductions | Sections/Classification of IRS |

|---|---|---|

| Individual (Indian Residents) / Body Corporate | 50% | 80G of Income Tax Act, 1961. |

| US Residents & Corporates | EIN/Tax ID: 81-2066314 | 501 chapter 3 classification of IRS. (IIITHAF) |